- The VA doesn't have a minimum credit score requirement, but most lenders require at least a 620 credit score to qualify.

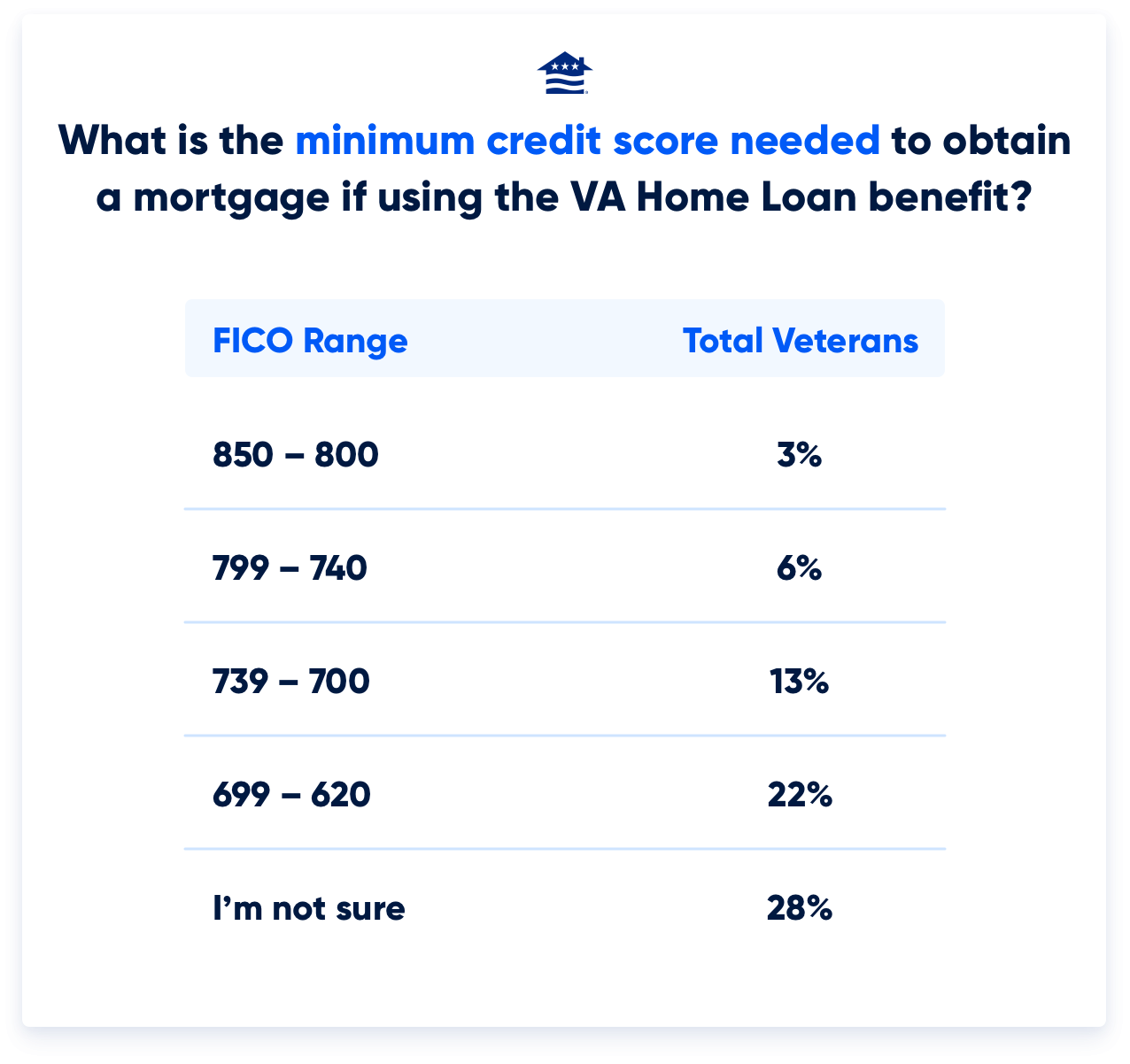

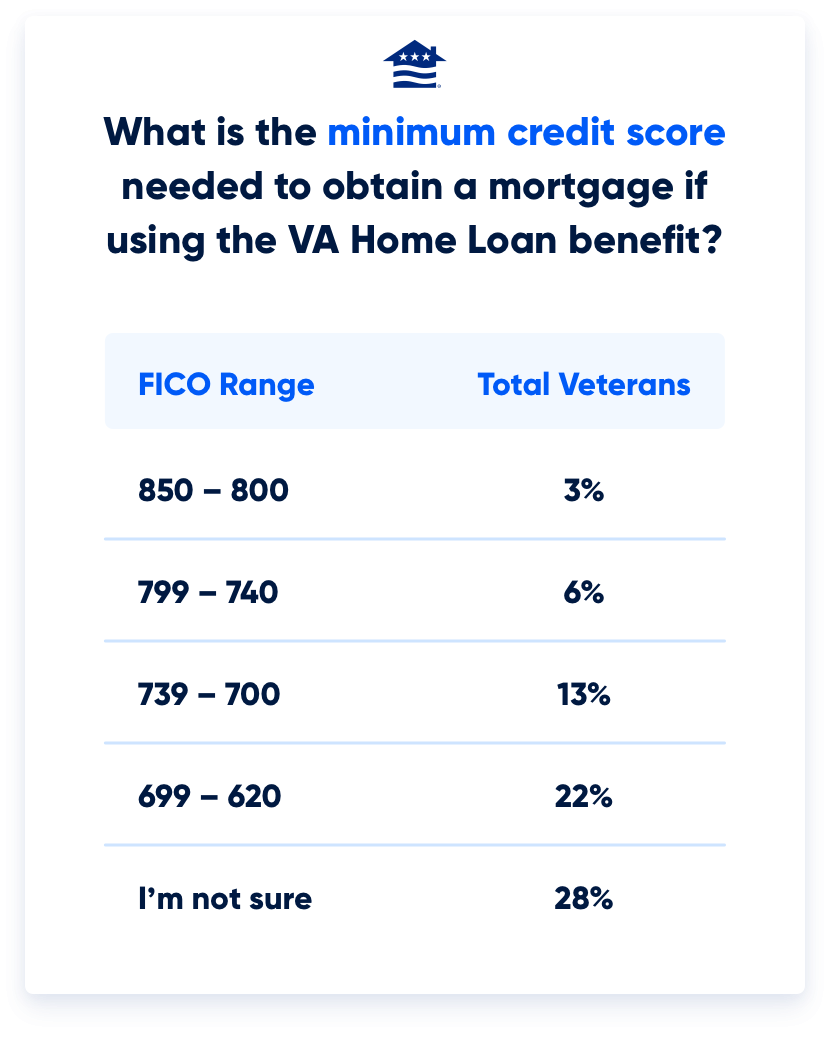

- A new survey shows many Veterans overestimate the kind of credit score they need for a VA loan.

A good credit score is an excellent starting point for anyone considering a mortgage, including a VA loan. However, one of the best benefits of the VA loan program is its relaxed credit requirements.

Potential homebuyers don't need blemish-free credit and elite credit scores to secure VA financing or get advantageous rates and terms. The VA loan program seeks to accommodate as many military buyers as possible with a simple and accessible mortgage.

What is the Minimum Credit Score for a VA Loan?

The VA doesn't set a minimum credit score for VA loans at the program level. Instead, the VA allows lenders to set their own minimum credit score requirements based on their risk tolerance.

Most VA lenders require at least a 620 credit score, but some may accept a lower score with additional financial scrutiny. High loan amounts, such as those exceeding $1 million, may require a higher credit score.

At Veterans United, we typically look for a minimum median FICO® credit score of 620. If your credit score is lower, don't worry. We have a team of credit consultants who work to improve or even establish your credit score — no strings attached.

VA loans are specifically designed to make homeownership more accessible for Veterans and service members. Their flexible and forgiving credit guidelines play a crucial role in making homebuying achievable.

However, half of all Veterans are either unaware of the credit requirements for a VA loan or believe they need much higher credit scores than is typically necessary. That’s according to a survey of Veterans and active duty service members conducted by Sparketing.*

While credit score minimums can vary by lender and other factors, Veterans don’t need excellent credit to qualify for a VA loan.

In fact, that common 620 score cutoff falls into the “Fair” credit range, which is a step below “Good,” two steps below “Very Good” and three tiers below “Exceptional,” according to FICO’s categories.

Why Doesn't the VA Set a Minimum Credit Score?

The VA's role in the VA loan process is to oversee the program and guarantee a portion of each loan in case of default. But the VA does not issue loans, and the agency does not enforce credit score minimums. Private lenders handle both of these duties.

While the VA does not set a minimum credit score requirement, it does establish other eligibility guidelines that potential borrowers must meet for lenders to approve them for a VA loan. These requirements and the additional standards that lenders may impose, often called lender overlays, can significantly impact a borrower's ability to qualify.

Most VA lenders set their own credit score benchmarks, which means applicants below that standard often can’t qualify for a VA loan. At Veterans United, we know there’s more to your story than just a number. That’s why we work with Veterans to improve or build their credit.

VA Loan Credit Requirements vs. Other Loan Programs

FICO credit scores range from 300 to 850. According to FICO, the average credit score in 2024 was 717, one point lower than in 2023.

Below are common benchmarks for other loan programs compared to the VA loan.

Minimum Credit Score By Home Loan Type

| Loan Type | Minimum Credit Score | Minimum Set By |

|---|---|---|

| VA | 620 | Lender |

| Conventional | 620 (740 for favorable loan terms) | Fannie Mae and Freddie Mac |

| FHA | 500 | U.S. Department of Housing and Urban Development (HUD) |

| USDA | 640 | Lender |

Conventional Loans

The government does not back conventional loans. Since lenders are at greater risk without a government guarantee, conventional loans are tougher to obtain. Bigger down payments and higher credit scores are usually required to snag conventional financing.

According to John Councilman, federal housing chairman for the National Association of Mortgage Brokers, a credit score below 740 could bring on added scrutiny and sizable fees in the conventional lending market.

As a result, most conventional borrowers maintain impressive FICO scores. According to the most recent data from the Home Mortgage Disclosure Act (HMDA), conventional borrowers in 2024 had an average credit score of 755—14 points higher than the previous year.

FHA Loans

Like VA loans, the federal government backs FHA loans. Requirements from the FHA allow lenders to go down to a 500 credit score with a 10% down payment and 580 with a 3.5% down payment. Home Mortgage Disclosure Act (HMDA) data for 2024 shows that FHA borrowers had an average credit score of at 692, compared to VA loans at 725.

While credit score requirements are typically lower than VA, FHA loans come with additional fees and often less favorable rates. Aside from a 3.5% or 10% down payment, FHA loans require an upfront mortgage insurance premium and monthly mortgage insurance, which continues for the life of the loan.

It's also not uncommon for FHA lenders to have a higher credit score minimum than the program itself.

USDA Loans

USDA loans are yet another government-backed option, but they're only available in rural areas.

The USDA does not enforce a minimum credit score, but like other government-backed options, lenders often do. Most USDA lenders want a 640 FICO score since it’s the cutoff for lenders to use the USDA's Guaranteed Underwriting System. This is an automated tool to help lenders assess a borrower’s eligibility by analyzing credit, income and other financial factors.

The average credit score for successful USDA borrowers in 2024 was 700, according to HMDA. Since the USDA program is government-backed, lenders can afford to take on borrowers with lower credit scores — and because the USDA only applies to rural areas, loan amounts stay lower. The median loan amount for USDA originations was $175,000 in 2024, as opposed to $235,000 for all loan types.

How to Check Your Credit Score

You actually have more than one credit score, and slight variations between them are normal. The credit score you see from free credit services is likely different from the one lenders use for mortgage approval. Credit agencies use unique data to calculate scores, and lenders often rely on specific scoring models depending on the type of loan.

Here are some of the primary ways you can access your credit scores:

- Reach out to your credit card provider or bank: Many credit card issuers, banks and credit unions include free credit score monitoring as part of their online services or mobile apps.

- Request a credit report: Under the Fair Credit Reporting Act, you’re entitled to one free credit report every year from each of the three major credit bureaus (Equifax, Experian and TransUnion) at AnnualCreditReport.com. While these reports don’t typically include your score, they offer valuable insights into your credit history.

- Pay for a credit monitoring service: If you want more in-depth analysis and real-time alerts, you can subscribe to a paid service through companies like MyFICO or Experian.

What to Do If You Don’t Meet the Lender’s Credit Score Requirement

Potential VA loan borrowers don’t need to abandon their dreams of homeownership due to a low credit score or no credit history. The best feature of credit is its fluidity. Your credit changes constantly.

Improve your fiscal habits, and your credit score will gain positive momentum. But knowing what improvements to make can be tricky. Should you pay off high-interest debt? Should you cancel certain credit cards? How should you handle that bankruptcy looming over your credit report?

If you're considering a VA loan but need help navigating your credit options, get help from the Veterans United credit consultant team.

Our credit consultants work with Veterans to improve their credit and get on the path to loan preapproval. This complimentary service has helped more than 50,000 Veterans boost their credit and ultimately close on a home loan.

Get some clarity on your financial situation by talking to a Veterans United loan specialist at 855-870-8845 or get started online today.

*Survey Methodology

A national survey of 300 respondents, split evenly between active duty service members and Veterans, conducted by data and analytics firm Sparketing on behalf of Mortgage Research Center, LLC.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Apr 3, 2025

Written ByTim Alvis

Reviewed ByTara Dometrorch

Minor updates to borrowers credit and loan amount statistics for all loan types with updated 2024 Home Mortgage Disclosure Act (HMDA) data.

Feb 28, 2025

Written ByTim Alvis

Reviewed ByTara Dometrorch

Major updates to ensure clarity and incorporated comparison table. Content fact checked and reviewed by team lead underwriter Tara Dometrorch.

Veterans United often cites authoritative third-party sources to provide context, verify claims, and ensure accuracy in our content. Our commitment to delivering clear, factual, and unbiased information guides every piece we publish. Learn more about our editorial standards and how we work to serve Veterans and military families with trust and transparency.

Related Posts

-

5 Most Common VA Loan Myths BustedVA loan myths confuse and deter many VA loan borrowers. Here we debunk 5 of the most common VA loan myths so that you can borrow with confidence.

5 Most Common VA Loan Myths BustedVA loan myths confuse and deter many VA loan borrowers. Here we debunk 5 of the most common VA loan myths so that you can borrow with confidence. -

VA Loan Down Payment RequirementsVA loans have no down payment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements.

VA Loan Down Payment RequirementsVA loans have no down payment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements.